Commercial Fire Insurance

🔥 Commercial Fire Insurance

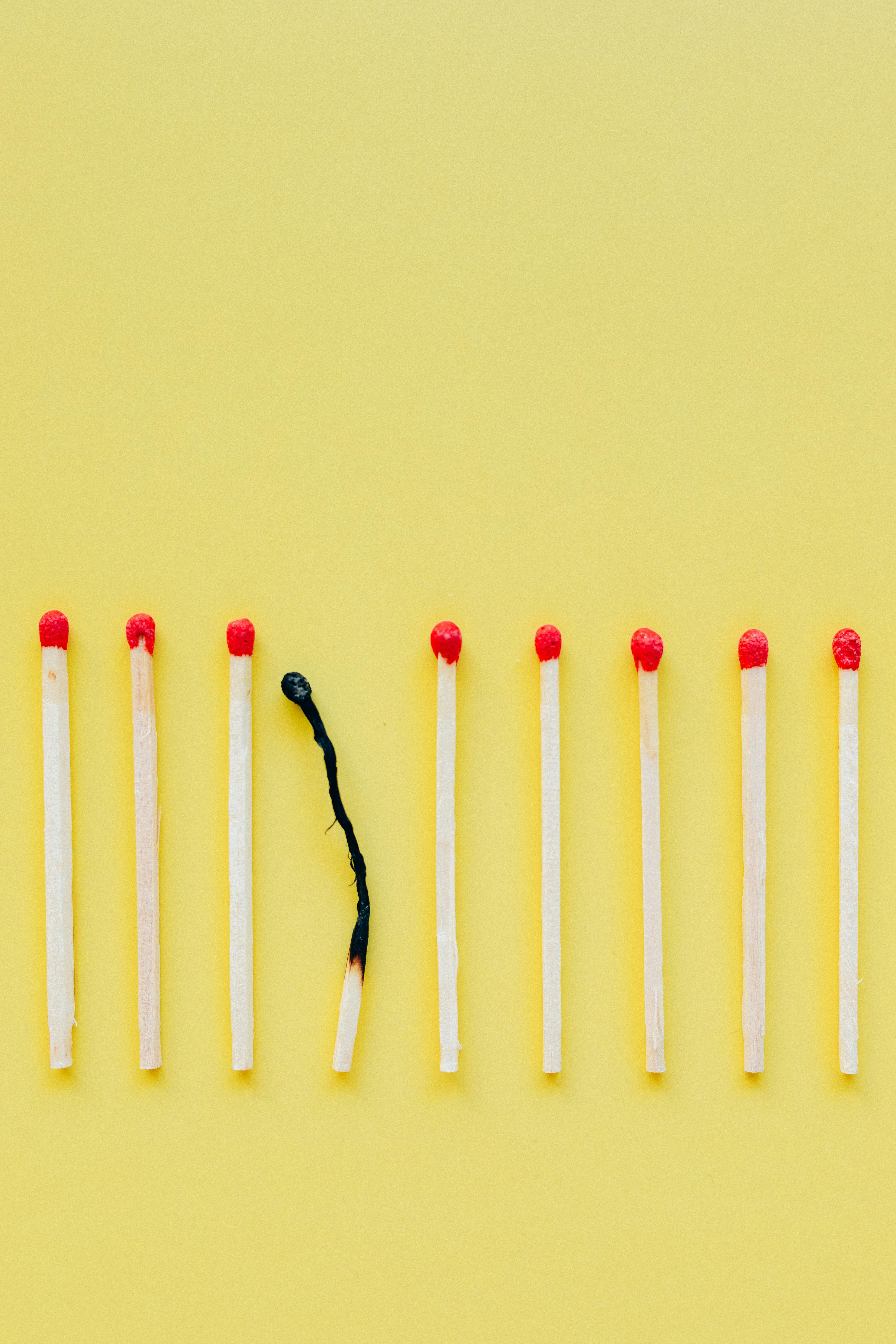

Protect Your Business Against Fire Risks

Small oversights in workplaces can lead to devastating fires and significant losses. Common risks include:

-

Unattended electrical appliances

-

Overloaded power outlets and extension cords

-

Poorly maintained electrical panels

-

Short circuits in electrical wiring

-

Improper storage of combustible materials

Taking preventive measures is crucial, but securing your business against potential damages through insurance is equally essential.

Can Insurance Commercial Fire Insurance safeguards your business and its assets against fire-related risks.

🛡️ Coverage Details

Core Coverage:

-

Fire: Damage caused by fire and related firefighting efforts

-

Lightning: Damages resulting from lightning strikes, even without fire

-

Explosion: Damages caused by explosions such as natural gas leaks, gas cylinders, or boiler blasts

➕ Optional Additional Coverages

You can extend your policy by adding the following coverages for an additional premium:

-

Earthquake and earthquake-induced fires

-

Flood and water damage

-

Internal water damage

-

Storm

-

Landslide

-

Damage caused by air, land, or sea vehicles

-

Smoke damage

-

Strikes, lockouts, civil commotion, and terrorism

-

Fire-related liability

-

Loss of rental income

-

Business interruption losses

-

Debris removal costs

-

Electronic equipment damage

-

Machinery breakdown coverage

📍 How to Apply

You can apply for Commercial Fire Insurance through:

📞 Can Insurance Head Office Fire Service

Phone: +90 392 444 0777

Email: info@cansigorta.com

Take action today to avoid regrets tomorrow.

Protect your business with the confidence of Can Insurance.